Raising Financial Freedom

Raising Financial Freedom

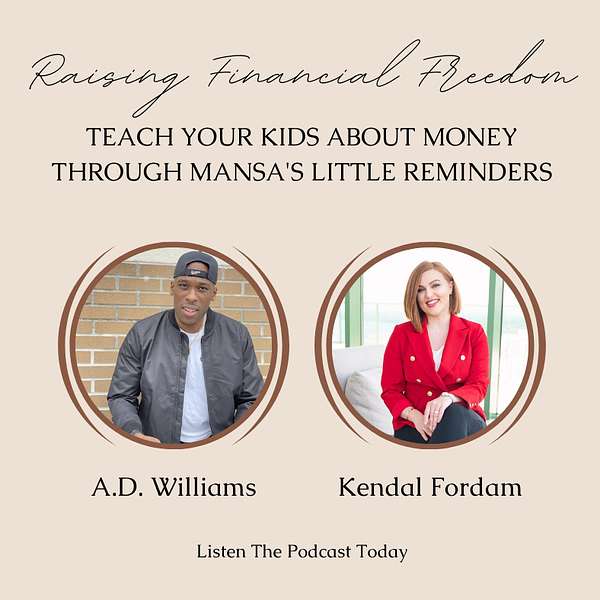

Teach Your Kids About Money Through Mansa's Little Reminders

#028 A.D. Williams shares that he did not receive any financial education as a child, and this was part of the reason for the book. In contrast, Kendal Fordham did have a lot of financial education, particularly as a result of spending time with her father who initially was too busy, and had to intentionally make out time which he spent reading financial books to her.

Financial literacy is the foundation of a much larger issue; it needs to be in schools but the debate is usually on when to start. Kendal believes that financial education should start from Kindergarten; kids should learn the value of money as they learn to read and write. Williams adds to this the importance of also having these conversations in the home, such that the learning is now in two folds.

For complete show notes go to Raising Financial Freedom

- "Fear of failure will never leave, you just have to continue to psych yourself out"

- "The average American family does not have enough to cover 3 months of bills if they were to lose their jobs"

In This Episode:

· [01:39] Today's guests are A.D. Williams and Kendal Fordham, and the topic is their book "Mansa's Little Reminders".

· [02:20] Growing up, what kind of lessons did you receive about money and financial literacy?

· [04:00] What bothers you when you see the state of financial literacy today?

· [05:09] What amazes you about your current knowledge on financial literacy which was absent while growing up?

· [07:36] How do you feel about the school system trying to implement more of an entrepreneurial mindset?

· [08:36] About the book, "Mansa's Little Reminders".

· [12:03] Kendal shares what she passes on to her kids.

· [16:40] What challenges did you face creating this book?

· [17:45] What is the one resource that you use when it comes to financial literacy?

· [18:57] Among Saving, Budgeting, and Investing, which would you pick?

· [20:33] How do parents overcome the fear of talking about money with their children?

· [21:33] What is the best piece of advice you can give to a parent who is just starting financial literacy at home?

· [22:39] What would you say if you had to do it all over again?

· [24:17] How to contact our guests.

Links Mentioned:

- Website: www.mansaslittlereminders.com

- Email: hello@mansaslittlereminders.com

- Check out our website: https://raisingfinancialfreedom.com/

- Like us on Facebook: https://www.facebook.com/RaisingFinancialFreedom

- Like us on Twitter: https://twitter.com/RF_Freedom

Dollars and Sense free bundle give away!

[00:00:00] Eric: [00:00:00] Today on episode 28 of raising financial freedom. I have two good guests for you today. A D Williams and Kendall for him. Now, these two young people are co-creators of the book. Manse's little reminders. Now this book introduces the beginning concept. Of money to kids and helps introduce other concepts of financial literacy to young adults.

[00:00:24] For me, when I read the book, it had a lot of realistic financial situations that see every day that kids may or may not understand. So today we're going to learn how to teach your kids about money through the book. Man says little reminders, so let's get this started and.

[00:00:46] Host Daughte: [00:00:46] Come on dad, stop playing around and play the music.

[00:00:49] Tough crowd.

[00:00:56] Introducer: [00:00:56] Have you ever wondered why some people seem to have it all financially? [00:01:00] Do well-off parents simply hand their children money or is there more to this welfare? Welcome to raising financial freedom. The podcast, we are here to talk about everything you never knew to teach your children when it comes to starting their financial future, the principles behind wealth and methods that are out there to teach your child.

[00:01:18] Personal financial freedom. There was no real trick to earning other than money. We are here to discuss, teach and grow with you. Raising financial freedom, the podcast with your host and concern here, Eric yard. Let us get right into today's show.

[00:01:37] Eric: [00:01:37] Welcome everybody. To another episode of raising financial freedom today, I would like to welcome Ady Williams and Kendall for them.

[00:01:53] Kendall. How are you doing sensational? Yeah. Good, great. Or right. We're here to talk [00:02:00] about that says little reminders. I read this book and to tell you the truth, I like the points that the book covered when it comes to financial literacy, it covered some major crucial points. And we're going to definitely get into that.

[00:02:15] Both for what I want to know for right now is when you guys were growing up, what kind of lessons did you receive about money and financial literacy?

[00:02:23] A.D. Williams: [00:02:23] Yeah, I'll jump into it. Not much. I remember of course school and in basics of math, but in regards to financial literacy, I've heard the term bonds, you know, your granddaddy got you some bonds.

[00:02:35] So I never materialized. And of course some my mother paying bills and saw her going to and from work. But in regards to actual financial literacy education, formal or informal, I can't tell you that I got any other reasons. Kendall. So

[00:02:52] Kendal: [00:02:52] I was raised in a very financially literate household. It didn't start that way.

[00:02:59] So my [00:03:00] dad began in the finance industry when I was first born right after I was born. And this is in the early nineties when the industry was. Booming in an honest way to more massive boom as it approached the tech bubble. And he wasn't around a lot as he began his career. And my mom gave him an ultimatum, if you need to be more present or we are out.

[00:03:23] And that was when my journey started. So he would bring me to the office and the periodicals and educational articles. He had to read like Bloomberg and barons and market updates. He would read with me. So that's how I learned how to read. It's by the age of 10, 11, 12. I knew how to, I knew the basic personal finance concepts.

[00:03:44] I knew the importance of saving what inflation was, and I was knew how to evaluate companies and how to invest in stocks and what bonds and real estate works. So I started

[00:03:55] Eric: [00:03:55] that's good. That's very good to know about stocks at a young age is that's a hell [00:04:00] of a. Oh headstart yet you can get, so tell me this guys, what really bothers you when you see the state of financial literacy today?

[00:04:08] Kendal: [00:04:08] I think that financial literacy is. The foundation of a much larger issue. It needs to be in schools. And I think everyone agrees with that, but it's the starting point of where people disagree. Usually it's middle school, high school and need, it needs to start in elementary. We need to be teaching about money and kindergarten at the same rate or starting point at which you learn to read, you need to learn the value of money and saving and what that looks like.

[00:04:38] A.D. Williams: [00:04:38] Yeah. And I would add up to that point just overall how under undervalued it is to Kendall's point in the classrooms, but also in households across the country, specifically, folks that look like me, black and brown individuals. I think there's two fold opportunity. One from the schools and then two, just to have these kinds of conversations earlier on in, [00:05:00] in households, even at a foundational level.

[00:05:03] So for us, we certainly. So a huge opportunity to spark these conversations in education early.

[00:05:11] Eric: [00:05:11] What amazes you about what you know about money and financial literacy now compared to what you. Did not know when you were

[00:05:20] A.D. Williams: [00:05:20] little. Yeah. Not to, not to downplay the complexity. And it goes under this certain thing, you can go to the depths of this and become an expert like Kindle is.

[00:05:28] But for me, it's just how simple it is. Once you grasp on to just the idea of investing. I think we all, for most of us had a piggy bank and we understand the concept of saving, but on the grand scheme of things, Investing to be justice, just as a simple. So for me, it's like, dang, like I got my first job at 16 at Kmart would just do something that I did putting money into the savings account and putting it into a brokerage account.

[00:05:54] So for me, I was like, wow, like this isn't rocket science. It just like Kindle. We could have 20, 30, [00:06:00] 40 thousands of her that get this kind of education earlier on. Similar how she did. What kind of

[00:06:05] Eric: [00:06:05] change did you want to see to happen to community after putting a book out there? Oh, I

[00:06:11] A.D. Williams: [00:06:11] think the first step is the conversations in the education thing.

[00:06:15] I want folks to be excited about this and it's just become part of everyday conversations. Of course we'll have curriculum. We will have some formal things. But what I've learned is that the folks that we aren't, you know, I hope to have this emulate. This is just regular conversation. It's just. Something you do.

[00:06:33] When you say you invest, you buy real estate, et cetera, et cetera. So for me, short term, it's starting the conversations, seeking the education and just being excited and interested about it. And then longterm, we start to see that wealth equity gap close and get smaller and smaller because right now is wide.

[00:06:51] And in this a tremendous uphill battle. I

[00:06:54] Kendal: [00:06:54] would add to that and say, I would want to see more career education. I would want to, [00:07:00] everyone wants to grow up and be an athlete or a performer entertainer. What about business owner or a franchise owner or an author or a manager? I want more education and conversations around success and what that looks like for other careers that aren't in the spotlight.

[00:07:18] I think that there's. Or now I hear like my youngest brother, there's a huge interest in his generation to be influencers, but I'm thinking of how saturated that market is. I want more education on different career options at a younger age. So kids can aspire to be more and understand that it is okay to own three taco bells like that.

[00:07:36] That would be an awesome career and a very successful, you went

[00:07:38] Eric: [00:07:38] into that. What, how do you feel about the school system trying to implement a more of an entrepreneurial. Mine or lessons might say to the children in

[00:07:48] Kendal: [00:07:48] school. Right? I don't think it's there. I think that kids now are getting a lot of inspiration from social media and I think social media inspires and motivates people to be [00:08:00] entrepreneurs, which is I'm an entrepreneur.

[00:08:01] It's an incredibly rewarding. Career choice, but I think it glamorizes, it, it is hard work. I don't work a 40 hour job. I don't get holidays paid sick leave. I'm working 60, sometimes 80 hours. I'm working on the weekends. And I think that there, if there's better education on the options, maybe there'd be less people trying to be you tubers or influencers and more people.

[00:08:27] Trying to learn how to start a profitable business or learning about how to climb the corporate ladder about 401ks and other things like that. Cause there's no shame in that and you can be very successful. Yeah, I believe

[00:08:38] Eric: [00:08:38] so, too. So let's talk about man says little reminders. Tell me what was your. And put on to this project.

[00:08:45] And what was the main point of

[00:08:48] A.D. Williams: [00:08:48] this book? Yeah, so I'll kick it off. And the main point of the book was to instill confidence, inspiration, and of course, financial literacy in this [00:09:00] whole plight of wealth equity through these characters, these characters go through things that. Children go through every day, whether it be having a disagreement with their mom or going to the cornerstone with their friends and cousins, or being excited about peace at night to, to seeing a squirrel or, you know, kids across the world see squirrels every day.

[00:09:19] And now this will not be talking to you, but I think that has the dynamic. So it just. Try to normalize everyday activities, but instill and infuse these key things. I believe in yourself and being okay with being a little bit different and being aware as a student in daydreaming about your future, writing those things on paper, and most importantly, starting something for yourself and learning about.

[00:09:43] And all things that come with financial literacy. So we want it to be fun, but also hit on those points.

[00:09:49] Kendal: [00:09:49] Yeah. I would say the sole purpose, in my opinion, would be to get this book in the hands of the children that are products of the underserved communities that need to [00:10:00] read it. I think we published it recently.

[00:10:02] And a lot of the feedback has been from our friends and family, which aren't necessarily the people I want. Yeah. To have the book and I want it in the schools and fourth grade, maybe third grade, and I want there to be a curriculum and I want kids learning it. I

[00:10:16] Eric: [00:10:16] liked about the book is that it definitely rooted you in what is going on today.

[00:10:22] Mark has got his little. Black Panther. T-shirt he's trying to cut. You're trying to comprehend the cost of bacon and sausage and seeing why he cannot have both. How important was that to him to implement that

[00:10:36] A.D. Williams: [00:10:36] into the book? Almost critical. I think it summarizes me coming up in conversations I've had with my parents said just not really.

[00:10:44] The understanding the why I mentioned earlier that I saw my mom going to work and working two jobs. I saw her paying bills, but never really had a chance to sit down and talk to her and have her educate me on the why. So I got to see that as a child and as a, as an older brother and I kick it off [00:11:00] the Kendall, who's a mom now, and it may have some other kind of context.

[00:11:04] Kendal: [00:11:04] Yeah. So that was more interesting for me. So when the book got to me, it already had this like skeleton, this kind of plot, Ady had ideas that he wanted conveyed in the book. And that was one of them that was already there when I got it. And I remember reading it and trying to decide how to expand on it and thinking about my own privilege in that I never had.

[00:11:25] A conversation like that. Even when I, in my eyes, we didn't have a lot of money. I never was told I never had to make a decision like that. So it was very interesting to look back at my own experience and compare it to what. I mean, this might NAD, correct me if I'm wrong, if I'm wrong, but this is not, you know, a biography of eighties childhood, but he did take a lot of his experiences and put them into this book in which I expanded on.

[00:11:54] And it was just very interesting to look back and be like, wow, I'm. Never had to think like [00:12:00] this, and now I'm writing a book on it. So for

[00:12:02] Eric: [00:12:02] me, that's interesting. That's real interesting. Kendall. You, you said you have kids. Exactly. What are you passing on to your kid?

[00:12:09] Kendal: [00:12:09] Interesting. You ask that because I was just talking to my husband about this.

[00:12:12] How. Do we teach our children about one, how blessed they are and two but two, how to appreciate and value money when they are never going to have to struggle. So I am constantly in this writing. This book has helped me stress the importance of that, how our kids are very young for context, I have a two year old and a five month old.

[00:12:33] So they're not really that's. I would consider that a little too early to introduce bacon and sausage and why we can't have both, but that's a great, I haven't figured it out yet. I know that's something that I need to do as a parent, how to introduce these concepts in an extremely privileged environment that our children are growing up in with housekeepers and cooks.

[00:12:52] How do we make them appreciate money so that they

[00:12:54] Eric: [00:12:54] don't take it? I know you're not a parent, but you haven't any, any clues of how you [00:13:00] implement this, your time console, if you're time

[00:13:02] A.D. Williams: [00:13:02] do come. No, I think, I think the beautiful part about this whole process is that we're learning and Kindle was mentioned to us in the past.

[00:13:09] And each time we reread the book or get started off future series, like we're learning every day, I think there's this book and this series will stand the test of time for that exact reason. That no one person has it all figured out. Then it really does take community, me and us having these conversations within our households and with the neighbors and across our community.

[00:13:30] So I think that's the exciting piece. No, but here that they're together. Yes,

[00:13:35] Eric: [00:13:35] I did. What happened to the nine year old? Oh, that's not a perfect gauge. You're telling me,

[00:13:41] Kendal: [00:13:41] how are you

[00:13:41] Eric: [00:13:41] implementing? This is what I do with my little nine year old. So I try to change the way she thinks we play games. We pay a lot of money games, but one game I do playing with her, which she does not like, but I want her to see how the lessons within the game apply could be applied [00:14:00] outside into life, which is chess.

[00:14:02] So we play chess and we have. Financial literacy, literacy books that we sit down and. We talk about every week or every other week, because she does dance and then they school and she has a pretty full schedule. So I just try to fight for the little time that I can get from her. But yeah, I have financial literacy books that I hear from the show that I pick up on Amazon that I like.

[00:14:31] And. We sit down and we read it together. She tells me what she thinks about it. And I tell her what I think about it and what's going on in real life. But yeah, you got to do this if you don't do it. One thing I do believe in is that your child is the first teacher that they see every day and the last teacher that they see every day, so who best to teach them.

[00:14:51] But you so. Getting back to Manse's little reminders. What age is this book [00:15:00] targeting? Cause there's some math in there and I'm like, oh, they even have math problems in here. Or when she reads this book, shit, she's going to back out. You're trying to slip math into me now. So what, what age group are you trying to target

[00:15:12] A.D. Williams: [00:15:12] here?

[00:15:13] And go ahead. We did a lot of groundwork on the front end and really the range has been six and older. Who've had friends in the education field around them. Lexile studies and see, and it really falls within that, that six and older timeframe. But of course they're brilliant rockstar students and children across the world that may pick it up a little bit early, both in what we found that 66 and older is kind of range.

[00:15:39] Eric: [00:15:39] Okay. Okay. So she won't have no problems with that. When I tell her that what thing I liked about the book is that it pushes. The child to get a taste of the entrepreneurial person, they can be. How important was that to put it in the book, because you could have stayed away from it. You could have just been, it could have been a book about [00:16:00] saving and budgeting, but you threw it in.

[00:16:02] You guys do it in a book and you implemented it. Very good.

[00:16:06] Kendal: [00:16:06] I think that was so important because of failure. Failure is such a massive, it's a massive part of life in general. But being an entrepreneur, it is the foundation of it is what makes you a good entrepreneur is how you handle failure. And I think that was the portion of the book that I spent the most time trying to in a relatable way, articulate how to persevere.

[00:16:34] Through failure to where it wasn't scary. It was digestible, but it was, it was present. So to me that was the most important part.

[00:16:43] Eric: [00:16:43] What challenges did you guys face creating this book?

[00:16:48] A.D. Williams: [00:16:48] I think for us, it was confident in the story, confident in the goal, but just thinking through the best way to. To deploy it.

[00:16:56] And we have shared goals of wanting this in schools and also [00:17:00] classrooms and families across the world. So we just had to not overthinking it and put it out to Kendall's point. I think that fear of failure never leaves. You just have to continue to psych yourself out. So for us, it's been writing it for writing process was a while, and it'll just because we have life going on and be fast forward.

[00:17:16] And it's two and a half years. So for us to say, Hey, let's, let's just put it out there. As far as this, one of the best decisions that we could have made. Just how it's been received and the impact that has had

[00:17:27] Kendal: [00:17:27] in a short period of time. Yeah. I would say building a reliable and trustworthy like camp that is in our corner so that, because we'd never done something like this before and neither of us have in our respective careers.

[00:17:38] So it was trying to constantly make the next best decision when you don't really know the outcome, or we're not really modeling the behavior of anyone we know closely. That's

[00:17:48] Eric: [00:17:48] done it before. What is the one resource. That you guys use when it comes to financial literacy? I read a lot.

[00:17:57] A.D. Williams: [00:17:57] Yeah, I've been, I've been really [00:18:00] heavy on the YouTube and the audio features a number of Kendall's active on social media and just a number of them.

[00:18:07] Folks that I've stumbled on non-traditional folks that, that we'll get a sound and have similar interests to me that have taken over the airwaves, you know, via podcasts and YouTube. So we're trying to make sure to stay up on that on a weekly basis, in addition to reading as well. Okay.

[00:18:26] Kendal: [00:18:26] Yeah. I would say that reading.

[00:18:28] So a lot of scholarly articles that come out a lot of federal reserve data, small business data, but then also people. So I have. The blessing of owning a practice where there's constantly different people, different backgrounds, different ages coming in. And I talked to them and I asked them about these subjects, especially when it comes to the minority wealth gap in America.

[00:18:50] And we have very, sometimes high level. And sometimes we get really in depth, depending on who I'm talking to. And that information played a really big role in creating the content for the book as [00:19:00] well.

[00:19:00] Eric: [00:19:00] So the book covers to make three major points in financial literacy, which is saving budgeting, and then investing.

[00:19:07] If you had to pick one, what would you shout out to the world? Hmm,

[00:19:11] A.D. Williams: [00:19:11] I would

[00:19:12] Kendal: [00:19:12] say you start easy, start simple to not scare people. And that would, and that's always. Begin with saving, but then you have to be tricky with that, Eric, because you can save too much. So it's a delicate balance, but always start with saving.

[00:19:25] The average American family does not have enough to cover three months of bills if they were to lose their job. And so I think saving at its core is the most important.

[00:19:35] A.D. Williams: [00:19:35] Yeah. And I'm not going to go against the expert. I love the idea of starting small, but I'm going to throw it against the grain. I would say investing when I talk to.

[00:19:43] You know, my, my siblings, my family, folks that I grew up with, et cetera, it's like this concept of saving, whether we're extremely good at it or not as there's no, nobody from America, the top may company, you know how to save, but investing, I think is starting to become more normalized, but [00:20:00] not nearly as much as we think it is out of those social media can be last.

[00:20:03] So investing, I think is such a new concept that I would love that to be one that we grab onto and we learn more about. Earlier on. So

[00:20:10] Eric: [00:20:10] definitely for me, my personal favorite is investing, but the tater truth, if I had to pick one, it'd be budgeting because budgeting savings could fall under that.

[00:20:20] Investing could fall under that. If you budget correctly, you have money for savings. You have money for investing, you have money for spending. So for me, it would be budgeting, but I do love investing you. Can't, that's something, that's the fun part of, of financial literacy to me. Still to this day, money is still a taboo thing with parents and their children.

[00:20:41] How does the parent overcome that fear of talking about money with their child in your opinion? So in

[00:20:48] Kendal: [00:20:48] my practice, I encourage, and I want to say that I don't have all the answers, but in my practice, if somebody has,

[00:20:56] A.D. Williams: [00:20:56] if we lost it, but I love the idea of [00:21:00] bringing a child to practice. I'm glad you mentioned that because I think for me, it's just.

[00:21:05] This transparency. It doesn't have to start with the conversation around analyze it, stock charts. It is, Hey, you know what? Every month I get my paycheck and every month I pay a bill, you know, or every month I sit down and I figure out what money's going to go where? So that transparency I think is important.

[00:21:24] And it, that isn't rocket science. You going to do that regardless. So to Kendall's point, just bring your children and let them see. I think that transparency is huge. All

[00:21:34] Eric: [00:21:34] right. Okay. What is the best piece of advice you can give to a parent who was just trying to start off? And financial literacy with their child since your book definitely grazes the beginning of financial literacy.

[00:21:49] A.D. Williams: [00:21:49] Yeah, I think of course, grabbing the book and on the website, www.massislittlereminders.com. We have some additional resources that will at least get the ball rolling. So I think [00:22:00] taking advantage of the resources, this first upload scratches to serve this one. When you have a question from the book or the mark of Mr.

[00:22:06] Mom characters from the blood mentioned something, just Google it. So I think the book scratches the surface. Don't be scared to Google. Anything that you have questions about and being transparency. Just started to bring your children and your family, along with you on the journey. I can start by saying, Hey, I just downloaded a brokerage account or, Hey, I was $17 short for the water bill.

[00:22:28] And I think that transparency is education in itself. Yeah, I

[00:22:31] Eric: [00:22:31] think so too. Getting the other family members involved and that's what the book does. The book shows other family members. Yeah. Are influential into a child's financial literacy knowledge. What would you say if you had to do it all over again, what would you like to do from the beginning to now?

[00:22:50] A.D. Williams: [00:22:50] That's a good one. Yeah. I would ask more questions. Like I've been the lead, remember being a eight or nine year old and my grandma [00:23:00] watching me and my mom, even off the little work and coming down and sit at the table with, you know, everything was paid for at that point. So. But now the bills that on the paper and talking through them and my granddad doing the same.

[00:23:10] And I just remember just passively not. I look back, I was curious by the next any questions. So as a child, I would ask more questions. And the thing I'd tell my mom and grandparents now is the thing you should have, should have sat me down and. Just to be around and educated me and not be fearful that I wouldn't understand because those things stick with you.

[00:23:29] And I think Kendall was a living example of how smart, how much you sponges that not,

[00:23:36] Kendal: [00:23:36] yeah, I think, I think I would have appreciated it. More. I remember being just angry at my dad because I wouldn't be able to go outside and play until I could talk about what Johnson and Johnson's earnings were that day.

[00:23:48] So I think then I didn't appreciate it now. I do. And I'm constantly trying to think of how do I implement that to my children. I also would have talked to my friends about it more spread that, that [00:24:00] knowledge, which I was embarrassed of it, then I. Felt like a nerd because nobody else was doing that at 12 and 13, but they should.

[00:24:07] Yeah.

[00:24:08] Eric: [00:24:08] Yeah, definitely. Definitely. I guess he would have been the odd ball in the circle if you were talking about that parents. Yeah. But that's what we need. That's what we need. We need circles like that in order to get some movement within financial literacy. And not make it such a taboo topic to talk about.

[00:24:26] Okay guys, I want to thank you for coming on the show. You shared so much with us. Tell us how we could get in touch with you, what you have coming up in the future and any other projects. That you may have going on

[00:24:39] A.D. Williams: [00:24:39] right now. So the website, of course, www that masters little reminders.com as well as the email.

[00:24:45] Hello at met since little reminders that calm social media, all things mean it's just little reminders. And I think for us, we're committed. We have some more books coming out, so workbooks and hopefully coming to a, a [00:25:00] school. Near you. So we'd love to hear if you have ideas or have some influence at your school.

[00:25:06] I think we'll be down to collaborate, just super excited for when they got the books or we'll get the book at the hearing this I second.

[00:25:14] Eric: [00:25:14] All right. Once again, guys. Thank you for coming out to the show.

[00:25:19] A.D. Williams: [00:25:19] Thank you for having us, Eric. Yeah, keep us posted

[00:25:23] Eric: [00:25:23] one more time. I just want to thank Ady and Kendall for coming on the show and showing that it's going to take more than one person more than.

[00:25:32] Two people as a family. Um, I say, and even more say our community to help teach these children financial literacy and everything about money here in the present and in the near future. Once again, please follow and subscribe when you can. And let other parents know until next episode stay safe.

[00:25:53] Introducer: [00:25:53] We really hope you enjoyed this episode of financial freedom.

[00:25:57] The podcast stay connected with us directly [00:26:00] through raising financial freedom.com. You could also join the discussion on social media, which you can also find links on our website. If you would like to speak with us, please send us an email to info@raisingfinancialfreedom.com. And as always thank you for pushing your mindset towards a better reality.

[00:26:17] This concludes the most thought provoking portion of your day. Don't forget to please like, and subscribe to stay fully up to date until next time. Be kind to yourself and each other. .